Introduction

The digital transformation of tax systems is gaining momentum across the globe, and Malaysia is no exception. With the government mandating the adoption of e-Invoice in Malaysia, businesses of all sizes must gear up to embrace this digital transition. The Inland Revenue Board of Malaysia (LHDN) has announced that e-Invoicing will become a mandatory requirement starting August 2024 for large businesses, with a phased rollout for others.

This blog explores the features, benefits, and implementation tips of the e-Invoicing system in Malaysia, helping businesses understand what lies ahead and how they can prepare for seamless adoption.

What is e-Invoice in Malaysia?

e-Invoice in Malaysia refers to the electronic invoicing system regulated by LHDN, aimed at improving tax transparency, efficiency, and automation. Unlike traditional paper or PDF invoices, e-invoices are created, exchanged, and archived digitally in a structured format, validated in real-time by LHDN.

The Malaysian e-Invoicing initiative is part of the broader MyInvois system, aligned with global standards and regional best practices. The aim is to reduce tax evasion, streamline reporting, and simplify auditing processes for businesses and authorities alike.

Key Features of e-Invoice in Malaysia

E-invoicing has become an essential part of Malaysia’s digital transformation in business and taxation processes. As the Malaysian government promotes the adoption of electronic invoicing to enhance efficiency, transparency, and compliance, businesses need to understand the key features of e-invoice systems in Malaysia. This blog will walk you through the main characteristics and benefits of e-invoicing in the Malaysian context.

1. Legal Compliance and Standardization

e-invoice in Malaysia must comply with the standards set by the Royal Malaysian Customs Department (RMCD) and the Malaysian Digital Tax Invoice framework. These regulations ensure that electronic invoices contain the required information and are accepted for tax and auditing purposes. The standardization facilitates seamless communication between businesses and tax authorities, reducing errors and disputes.

2. Digital Format and Security

e-invoices are generated and transmitted in a secure digital format, commonly XML or PDF with digital signatures. The use of digital signatures ensures the authenticity and integrity of the invoice, preventing tampering or fraud. This digital format also supports easy storage and retrieval, eliminating the need for physical paperwork.

3. Real-Time Submission to Tax Authorities

One of the critical features of Malaysia’s e-invoice system is the ability to submit invoices electronically in real time to the tax authorities. This helps in faster validation, improved tax compliance, and instant record-keeping. Businesses benefit from reduced manual filing and faster processing of tax credits or refunds.

4. Integration with ERP and Accounting Systems

E-invoice solutions in Malaysia are designed to integrate smoothly with existing ERP (Enterprise Resource Planning) and accounting software. This integration automates the invoicing process, reducing manual data entry and the risk of human error. It also enables real-time synchronisation of sales and tax data, enhancing financial accuracy and operational efficiency.

5. Enhanced Data Accuracy and Validation

The e-invoice system validates key data fields before submission, such as GST registration numbers, invoice totals, and tax amounts. This feature ensures that errors are caught early, reducing the chances of rejected invoices or penalties from the tax department. Improved data accuracy also simplifies reconciliation and auditing.

6. Cost and Time Efficiency

By adopting e-invoicing, Malaysian businesses save time and costs for paper-based invoicing, such as printing, postage, and physical storage. Automated workflows speed up invoice generation and approval processes, enabling quicker payment cycles and better cash flow management.

7. Environmentally Friendly

E-invoicing supports Malaysia’s commitment to sustainability by reducing the reliance on paper invoices. This eco-friendly approach minimizes waste and contributes to the reduction of carbon footprints for businesses adopting digital solutions.

8. Audit Trail and Transparency

Every e-invoice created and submitted electronically is logged with a digital audit trail, providing transparency and traceability. This is especially useful during tax audits or financial reviews, as businesses can easily provide proof of transactions and compliance.

9. User-Friendly Interfaces and Accessibility

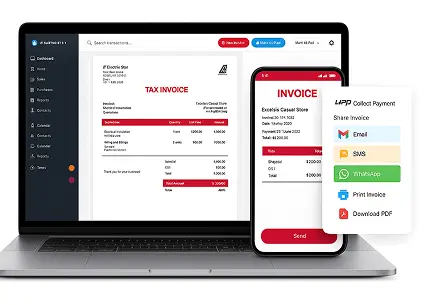

Modern e-invoicing platforms in Malaysia offer user-friendly interfaces accessible via web portals or mobile applications. This accessibility allows businesses of all sizes to manage their invoicing conveniently from anywhere, ensuring greater adoption and usability.

Benefits of e-Invoice in Malaysia

Electronic invoicing, or e-invoicing, is rapidly transforming the way businesses handle their billing and payment processes worldwide. Malaysia is no exception, as the government and private sectors increasingly adopt e-invoicing systems to streamline operations and improve financial accuracy. This blog will explore the key benefits of e-invoicing in Malaysia and why businesses should consider transitioning from traditional paper invoices to electronic invoicing.

1. Enhanced Efficiency and Speed

One of the primary advantages of e-invoicing is the significant improvement in efficiency. Traditional paper invoicing often involves manual data entry, printing, mailing, and physical storage, which are time-consuming processes. e-invoice are generated, sent, and received electronically, allowing businesses to reduce processing time drastically. This speed enhances the overall cash flow by shortening invoice cycles and accelerating payment receipt.

2. Cost Savings

E-invoicing helps Malaysian businesses reduce various costs associated with paper invoicing. Printing, postage, physical storage, and administrative labor costs are considerably lowered. Moreover, e-Invoices reduce errors that might lead to costly disputes or delays, saving both time and money on corrections and follow-ups. For SMEs and large enterprises alike, these savings can improve profitability and free resources for other operational needs.

3. Improved Accuracy and Reduced Errors

Manual invoicing processes are prone to human errors such as incorrect data entry, miscalculations, or misplaced documents. E-invoicing systems automatically validate invoice data, reducing errors and discrepancies. This accuracy ensures smoother reconciliation processes and minimizes disputes between buyers and suppliers. As a result, businesses experience fewer payment delays and enhanced trust between trading partners.

4. Better Compliance with Malaysian Tax Regulations

Malaysia’s tax authority, the Royal Malaysian Customs Department (RMCD), encourages digital solutions for tax reporting and compliance. E-invoicing helps companies comply with regulatory requirements by ensuring that invoices meet the necessary standards for tax purposes, including proper documentation of GST/SST and other tax elements. Electronic records also simplify audit processes and reduce the risk of penalties due to non-compliance.

5. Enhanced Security and Fraud Prevention

e-Invoices are transmitted through secure electronic channels, making them less susceptible to tampering, loss, or fraud compared to paper invoices. Many e-invoicing solutions include encryption and authentication features that verify the identity of the sender and integrity of the invoice data. This security reduces the risk of fraudulent invoicing and protects sensitive business information.

6. Environmental Sustainability

By switching to e-invoices, Malaysian businesses contribute to environmental conservation. Paper invoicing requires significant amounts of paper, ink, and transportation resources. E-invoicing drastically reduces paper consumption and waste, aligning with global sustainability goals and corporate social responsibility initiatives. Adopting digital invoices reflects positively on a company’s commitment to environmental stewardship.

7. Streamlined Record Keeping and Accessibility

e-invoices are stored electronically, making record-keeping easier and more efficient. Businesses can quickly search, retrieve, and share invoice records without sifting through piles of paper. This digital archiving supports better organization and faster response times during audits, financial reviews, or customer inquiries. Cloud-based e-invoicing platforms also enable access to invoices anytime and anywhere, supporting remote and flexible working environments.

8. Facilitates Integration with ERP and Accounting Systems

Many Malaysian companies use Enterprise Resource Planning (ERP) and accounting software to manage their finances. E-invoicing systems can integrate seamlessly with these platforms, enabling automatic data synchronization. This integration reduces duplicate work, improves data consistency, and enhances overall business process automation. Businesses can gain real-time insights into their financial status, enabling better decision-making.

9. Supports Business Growth and Competitiveness

Adopting e-invoicing positions Malaysian businesses as forward-thinking and technologically savvy. Faster invoicing and payment cycles improve liquidity, helping companies scale operations more effectively. Additionally, trading partners increasingly prefer digital transactions due to their efficiency and reliability. Businesses that implement e-invoicing can strengthen relationships with suppliers and customers, gaining a competitive advantage in the marketplace.

Implementation Tips for e-Invoice in Malaysia

With Malaysia increasingly embracing digital transformation, the implementation of e-invoice in Malaysia is becoming a vital tool for businesses looking to improve efficiency and compliance. However, transitioning from traditional paper invoicing to electronic invoicing requires careful planning and execution to maximize its benefits. Here are some practical implementation tips for businesses in Malaysia to smoothly adopt e-invoice systems.

1. Understand Regulatory Requirements

Before implementing e-invoicing, it’s essential to familiarize yourself with Malaysia’s regulatory framework related to invoicing and tax compliance. The Royal Malaysian Customs Department (RMCD) provides guidelines on invoice formats, GST/SST documentation, and electronic record-keeping standards. Ensuring your e-invoice system complies with these regulations will help avoid penalties and streamline tax reporting.

2. Choose the Right E-Invoicing Solution

Selecting an e-invoicing platform that fits your business size, industry, and workflow is crucial. Look for software that supports Malaysian tax requirements, offers integration with your current accounting or ERP systems, and provides features like automatic validation, secure transmission, and electronic archiving. Cloud-based solutions often offer flexibility and scalability suitable for growing businesses.

3. Train Your Team

Implementing e-invoicing involves changes in how your staff manage billing and payments. Provide adequate training to your finance, sales, and IT teams to ensure they understand the new processes and software tools. This will reduce resistance, minimize errors, and improve overall adoption.

4. Digitize Your Invoice Data

If you are transitioning from paper invoices, start by digitizing existing invoice records. This can be done through scanning and data entry or using Optical Character Recognition (OCR) tools. Digitized records enable easier migration into e-invoicing systems and provide a good baseline for future invoicing.

5. Integrate with Existing Systems

Ensure your e-invoicing platform integrates smoothly with your current ERP, accounting, or financial management systems. Integration automates data flow between systems, reducing manual entry and errors. It also allows real-time tracking of invoice status, payments, and reconciliation.

6. Pilot Test the System

Before fully rolling out e-invoicing, conduct a pilot test with a small group of users or clients. This helps identify any technical glitches, workflow issues, or compliance gaps. Use feedback from the pilot phase to refine processes and ensure the system works efficiently.

7. Communicate with Stakeholders

Inform your customers, suppliers, and partners about your transition to e-invoicing. Clear communication about the benefits, new procedures, and timelines helps ensure their cooperation and smoothens the invoicing process. Provide support for any questions or issues they might have during the transition.

8. Ensure Data Security and Backup

An e-invoice contains sensitive financial information, so securing this data is critical. Use e-invoicing solutions that offer encryption, secure access controls, and regular backups. Additionally, maintain compliance with Malaysia’s Personal Data Protection Act (PDPA) to safeguard customer and business data.

9. Monitor and Optimize

After implementation, continuously monitor your e-invoicing processes for efficiency and accuracy. Use analytics and reporting tools to track invoice cycles, payment times, and error rates. Use this data to optimize workflows, address bottlenecks, and improve overall financial operations.

10. Stay Updated on Regulatory Changes

Malaysia’s digital and tax landscape is evolving, with new rules and standards introduced from time to time. Stay informed about updates from RMCD and other relevant authorities to ensure your e-invoicing system remains compliant and takes advantage of new features or incentives.

Challenges in Implementing e-Invoice in Malaysia

While the benefits are significant, the implementation of e-Invoice in Malaysia can pose challenges:

- Resistance to change in traditional companies

- Incompatibility with legacy accounting systems

- Lack of skilled IT personnel for integration

- Misunderstanding of compliance requirements

- Initial setup and training costs

How Matiyas Solutions Can Help

At Matiyas Solutions, we understand the complexities of digital transformation and compliance. Our ERP software in Malaysia is designed to simplify e-Invoicing integration, offering features like:

- Automated invoice generation and real-time validation with LHDN

- Secure cloud-based invoicing with data backup

- Support for credit/debit notes, QR code generation, and UIN tagging

- Detailed financial reports and tax-ready documents

- Integration with existing CRM, inventory, and sales systems

We work with manufacturing, distribution, retail, and service businesses to ensure smooth digital adoption and regulatory compliance with e-invoice in Malaysia.

Conclusion

With the shift toward e-invoice in Malaysia, businesses must take proactive steps to digitize and align their processes with the latest regulatory frameworks. The benefits are undeniable greater compliance, real-time validation, efficiency, and significant cost savings. However, without the right tools and strategy, the transition could pose challenges. That’s why many SMEs and enterprises are adopting cloud accounting software in Malaysia to automate e-invoicing, ensure compliance, and streamline financial operations.

Matiyas Solutions is here to support your digital transformation journey. Our ERP solutions are built to ensure your invoicing processes are compliant, seamless, and future-ready.

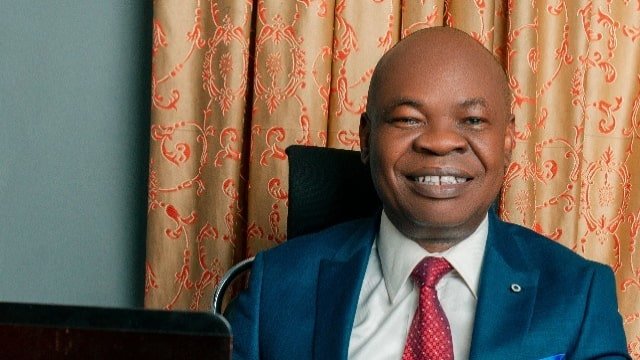

"I am quite happy with the ERP solution provided by Matiyas. Before we implemented their system, our organization was struggling with inefficient processes and fragmented data. Their customized ERP solution not only streamlined our workflows but also provided real-time insights into our operations. The customer support from Matiya's Team has been exceptional throughout the journey."

"I am quite happy with the ERP solution provided by Matiyas. Before we implemented their system, our organization was struggling with inefficient processes and fragmented data. Their customized ERP solution not only streamlined our workflows but also provided real-time insights into our operations. The customer support from Matiya's Team has been exceptional throughout the journey."

"Matiyas offered us a functionally strong and automated solution to address the end-to-end needs of our business operation. This solutions will be able to scale and grow our business and it will surely reduce manual interventions."

"Matiyas offered us a functionally strong and automated solution to address the end-to-end needs of our business operation. This solutions will be able to scale and grow our business and it will surely reduce manual interventions."

"I wanted to thank you Matiyas team to set-up the ERP system based on our business process. The assistance was invaluable in helping my company get as we requested. We sincerely appreciate your efforts and thanks again Matiyas team to provide us a best solution with the erp system."

"I wanted to thank you Matiyas team to set-up the ERP system based on our business process. The assistance was invaluable in helping my company get as we requested. We sincerely appreciate your efforts and thanks again Matiyas team to provide us a best solution with the erp system." "Go ahead with Matiyas and Capture data at lowest level and you can build | report | analyse | get insights across business dimension to take informed decisions."

"Go ahead with Matiyas and Capture data at lowest level and you can build | report | analyse | get insights across business dimension to take informed decisions."

"The implementation of the Matiyas ERP solution has revolutionized our workflow. The automation of previously manual processes has not only saved us time but also significantly reduced errors. It’s like having an extra set of hands on our team, streamlining operations and boosting productivity"

"The implementation of the Matiyas ERP solution has revolutionized our workflow. The automation of previously manual processes has not only saved us time but also significantly reduced errors. It’s like having an extra set of hands on our team, streamlining operations and boosting productivity"

"We would definitely encourage anyone willing to get services from Matiyas. they are honest hardworking and smart team. they stretch them maximum to achieve success for their clients."

"We would definitely encourage anyone willing to get services from Matiyas. they are honest hardworking and smart team. they stretch them maximum to achieve success for their clients."

"Matiyas system has been helpful to us for execution of our day-to-day operations in scholarship. The team has been very supportive and always available to accommodate with any challenges that we have faced. Overall, we had good experience working with Matiyas!"

"Matiyas system has been helpful to us for execution of our day-to-day operations in scholarship. The team has been very supportive and always available to accommodate with any challenges that we have faced. Overall, we had good experience working with Matiyas!"

"We at I2E Consulting were looking for Healthcare Module consultation in ERP and we came across Matiyas Solutions website. From managing the business to adding his Expertise in Healthcare module, Hasan has done it all single handedly. All our Queries were solved in a timely manner. Regular follow ups were done."

"We at I2E Consulting were looking for Healthcare Module consultation in ERP and we came across Matiyas Solutions website. From managing the business to adding his Expertise in Healthcare module, Hasan has done it all single handedly. All our Queries were solved in a timely manner. Regular follow ups were done."

"Our company is very new to ERP, we tried to implement ERP by ourselves, however along the way we found struggles as we are very new. We are lucky HasanAli from Matiyas helped us in many ways, from a simple question to very complex developments and deployments. Rates are reasonable too! We are happy that Matiyas is there to help us."

"Our company is very new to ERP, we tried to implement ERP by ourselves, however along the way we found struggles as we are very new. We are lucky HasanAli from Matiyas helped us in many ways, from a simple question to very complex developments and deployments. Rates are reasonable too! We are happy that Matiyas is there to help us."

"The folks at Matiyas Software are the best. They're skilled, work quickly and professionally, and were able to tailor ERP to our exact specifications. Would use them again."

"The folks at Matiyas Software are the best. They're skilled, work quickly and professionally, and were able to tailor ERP to our exact specifications. Would use them again."

"Very knowledgeable and prompt and professional. I highly recommend Matiyas for any ERP customizations."

"Very knowledgeable and prompt and professional. I highly recommend Matiyas for any ERP customizations." “Moving from long standing practices to a new system is always challenging. The Matiyas team handled the transition with professionalism and complete cooperation across all departments. The ERP is extremely user friendly and easy for every department to understand. Continuous support during implementation made the process smooth. Dashboard-based reporting has given us control over every department at the same time.”

“Moving from long standing practices to a new system is always challenging. The Matiyas team handled the transition with professionalism and complete cooperation across all departments. The ERP is extremely user friendly and easy for every department to understand. Continuous support during implementation made the process smooth. Dashboard-based reporting has given us control over every department at the same time.” “We had requested this customized report from another vendor, but they were not able to do it. Matiyas was able to customize the report exactly as per our requirements. We have been using ERP since 2016, and this report will help us significantly in decision-making. Matiyas's ERP is a good product.”

“We had requested this customized report from another vendor, but they were not able to do it. Matiyas was able to customize the report exactly as per our requirements. We have been using ERP since 2016, and this report will help us significantly in decision-making. Matiyas's ERP is a good product.” “Working with Matiyas gave us confidence from day one. Their ERP customization expertise and commitment to delivering the right solution made a real difference to our business.”

“Working with Matiyas gave us confidence from day one. Their ERP customization expertise and commitment to delivering the right solution made a real difference to our business.”